3+ hlib advantage loan

Low Fixed Rates HLIB Advantage Home Improvement Loan When 25000 isnt enough you may be eligible for the HLIB Advantage Loan with access to an additional 40000. The HLIB Advantage Loan Unsecured up to 25000 Terms Title 1 FHA Loan Secured - 36 60 84 120 180 and 240 Months Unsecured - 36 60 84 and 120 Months The HLIB Advantage.

Casestudy

These loan funds max out at 25000 and 40000 respectively.

. The HLIB Advantage Loan allows you to. We offer parent loans with lower rates than federal PLUS loans. A 203k loan is a type of FHA loan and has many of the same guidelines.

However the credit score requirement is higher you need at least a 640 score to qualify for a 203k loan. HLIB Advantage Home Improvement Loan. Are you in an Income-Driven Repayment IDR Plan.

Maximum loan amount of. The combination of loans held for investment net and mortgage loans. HLIB is recognized as one of Freddie Macs top 150 lenders in the country.

EXTREME POST FRAME Were here when. YOUR HOME IMPROVEMENT PARTNER Home Loan Investment Bank FSB is excited to introduce a brand NEW product for home improvement lending. The HLIB Advantage Loan Up to 25000 Unsecured up to 25000 Unsecured - 36 60 84 and 120 180 Months The HLIB Advantage Loan can only be offered in conjunction with The.

Only FHA-approved lenders can issue Title 1 renovation loans. No matter the project - replacing the roof remodeling the kitchen or bathroom. Home Loan is a national home improvement lender offering FHA Title 1 and our own HLIB Advantage Loan.

Re-certify your income annually on StudentAidgov Get answers to your questions about student loan. When 25000 isnt enough you may be eligible for the HLIB Advantage Loan with access to an additional 40000. HLIB Advantage Home Improvement Loan.

HLIB surpasses 10 billion in residential mortgage originations. HLIB begins offering USDA loans. Finance up to 25000 in additional funds in conjunction with The FHA Title I Loan for a total of.

Our Preferred Referral Program is FEE-FREE to contractors easy to join and. Consolidation into the Direct Loan program may allow borrowers with FFELP loans to take advantage of repayment plans or forgiveness options created solely for Direct Loans. The two main loan funds for solar are the FHA Title I Home Improvement Loan and the HLIB Advantage Loans.

Third Federals mission is to help people achieve the dream of home ownership and financial security. When 25000 isnt enough you may be eligible for the HLIB Advantage Loan with access to an additional 25000. HLIB Advantage Loan is here to help.

The FHA Title 1. Last week Home Loan Investment Bank FSB introduced the HLIB Advantage Loan program. It became part of.

Maximum loan amount of. These educational loans are for parents of undergraduate graduate and professional level students. Call Your Home Improvement Partner and take advantage of our exclusive program The HLIB Advantage Loan.

We have been the largest Title 1 lender in the nation 3 years in. Home Loan Investment Bank is proud to offer customers the FHA Title I Home Improvement Loan and the HLIB Advantage Loans. If your current lender isnt on the list you cant use them.

Must pay an insurance premium. Project the HLIB Advantage Loan allows you access up to 50000.

Small Business Grants Loans For Southern California

Loan To Financial Institution Wholesale Ardb Bank

How To Get A Joint Personal Loan In 2021 Lendingclub

Home Improvement Partners Home Loan Investment Bank

Best Online Mortgage Lenders Of October 2022 Forbes Advisor

Best Online Mortgage Lenders Of October 2022 Forbes Advisor

Best Online Mortgage Lenders Of October 2022 Forbes Advisor

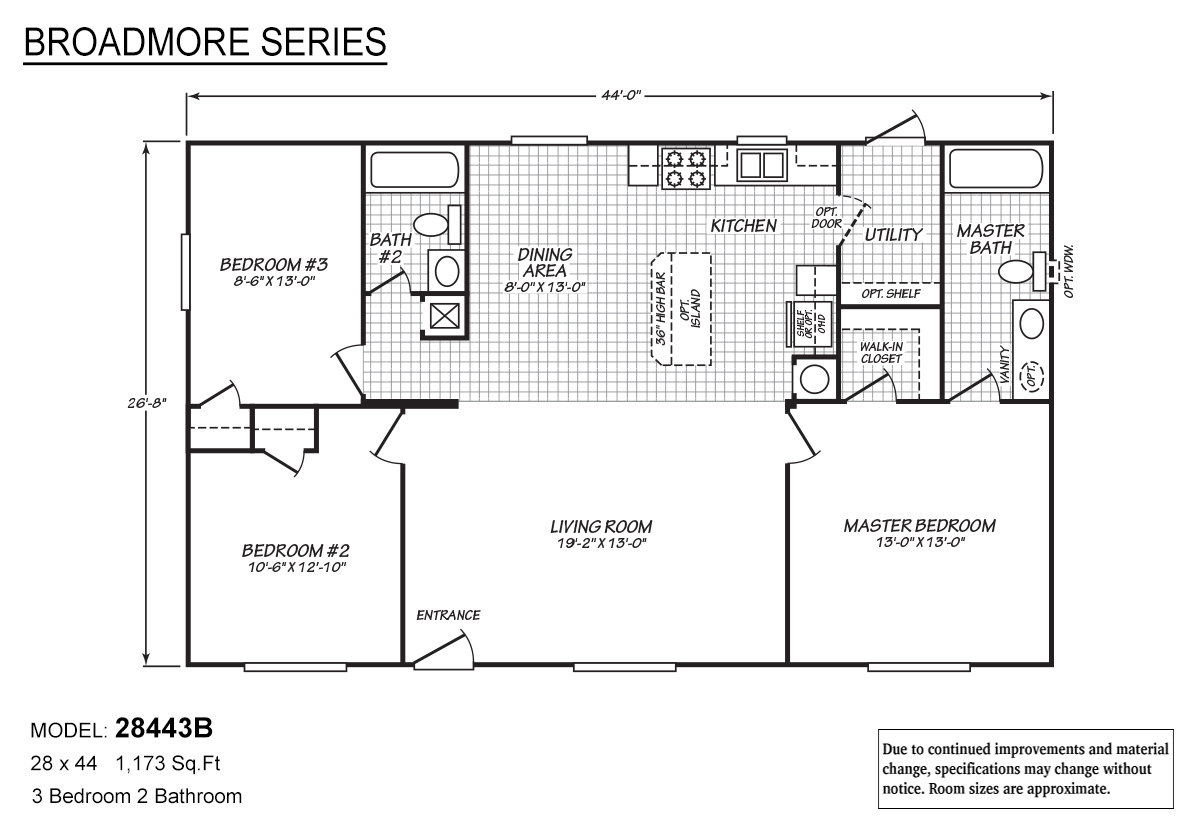

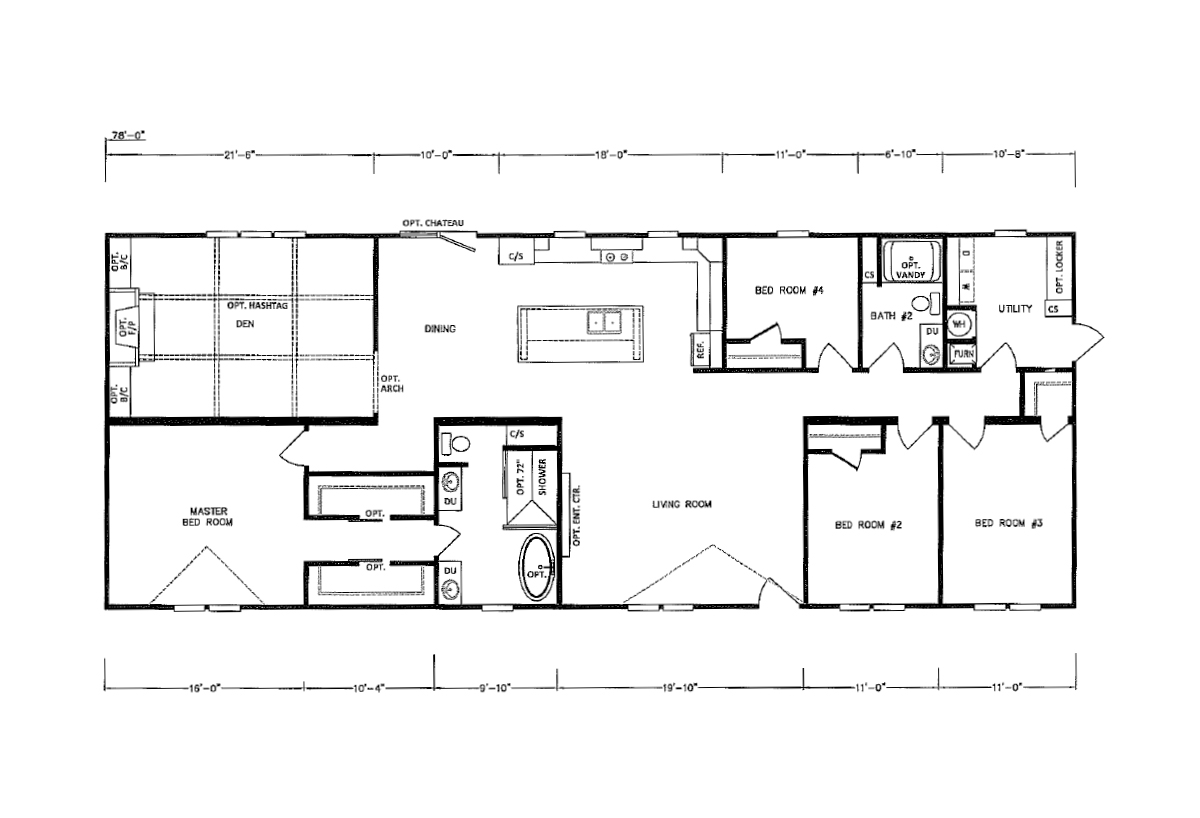

Mh Advantage La Manufactured Homes

Mh Advantage Star Homes

Manufactured And Modular Home Financing In Nevada Westwind Homes

Nwpnurjojcxnsm

Manufactured And Modular Home Financing In Nevada Westwind Homes

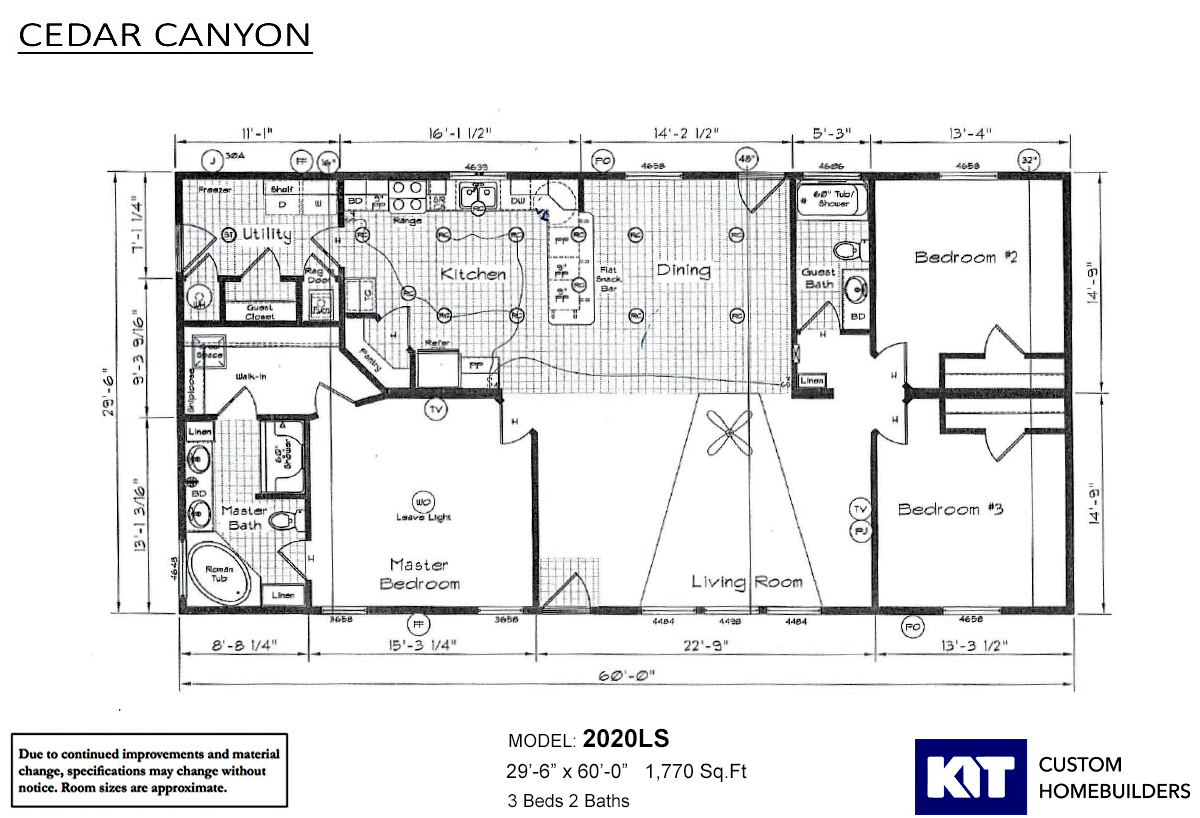

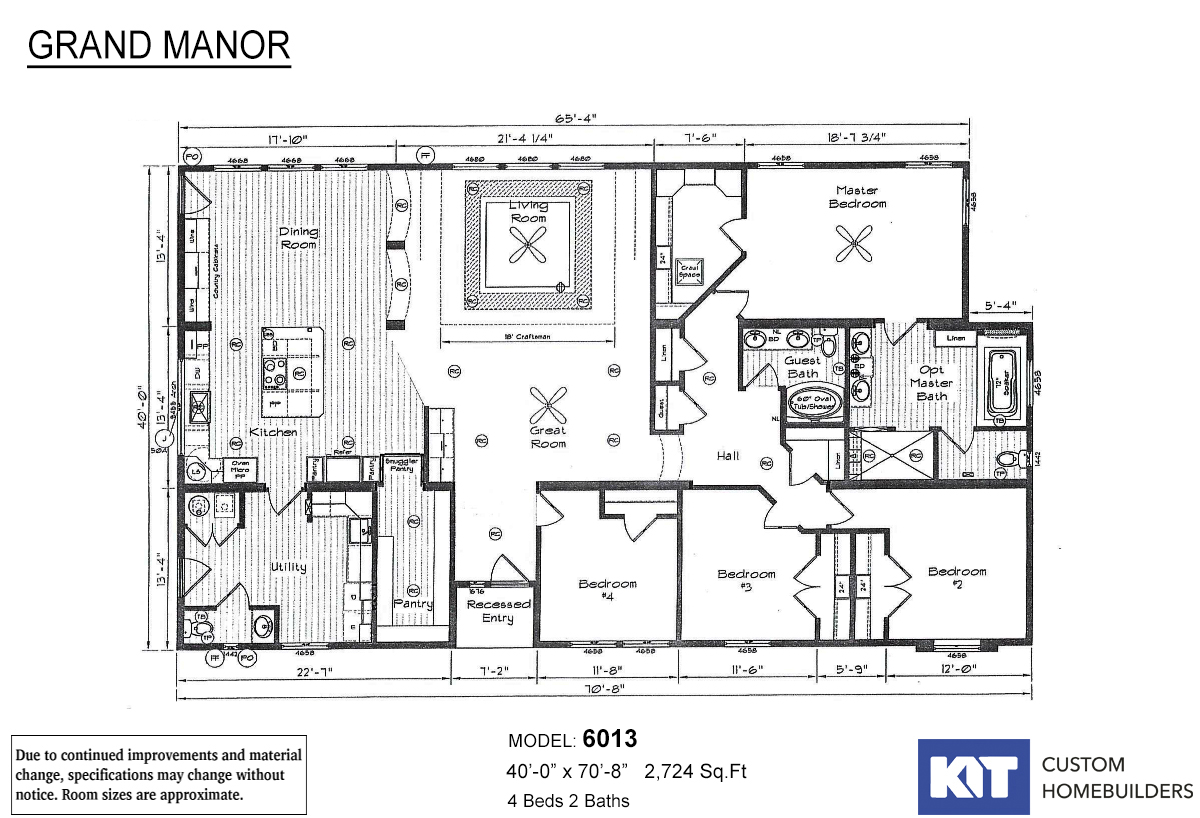

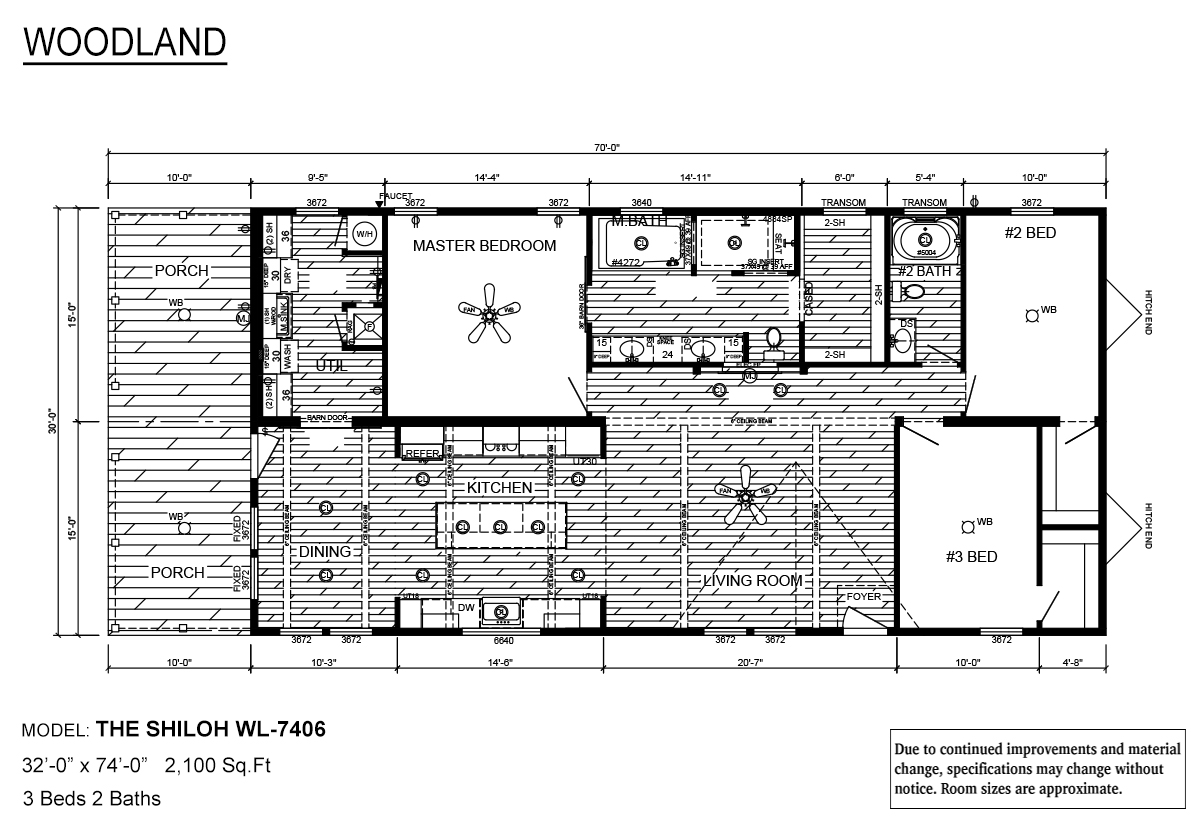

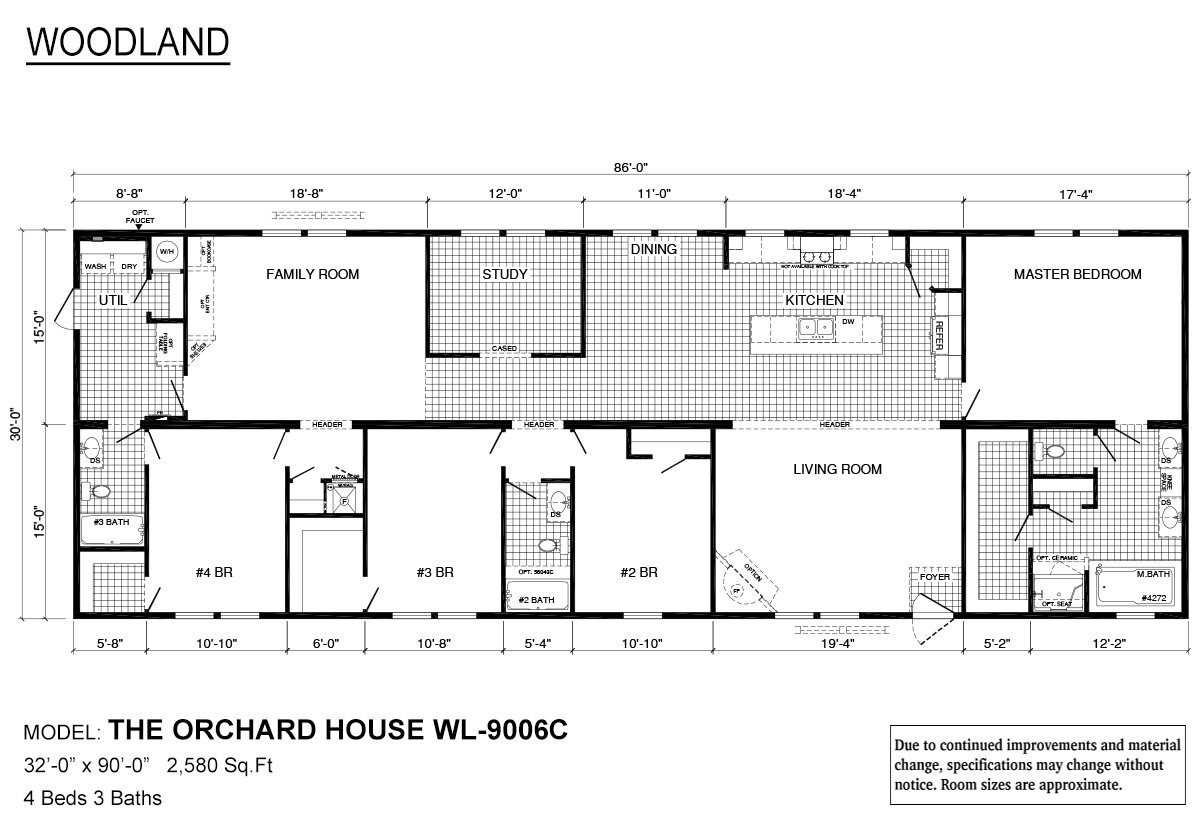

Woodland Homes Deer Valley Homebuilders Guin Alabama

Manufactured Homes Modular Homes Park Models Fleetwood Homes

Home

Mh Advantage Bolton Homes

Find A Manufactured Home Deer Valley Homebuilders